- Talking Africa-Europe -A Leadership Series

- Sustainable Finance

Follow the Money: Africa, Europe and the Fight Against Illicit Financial Flows

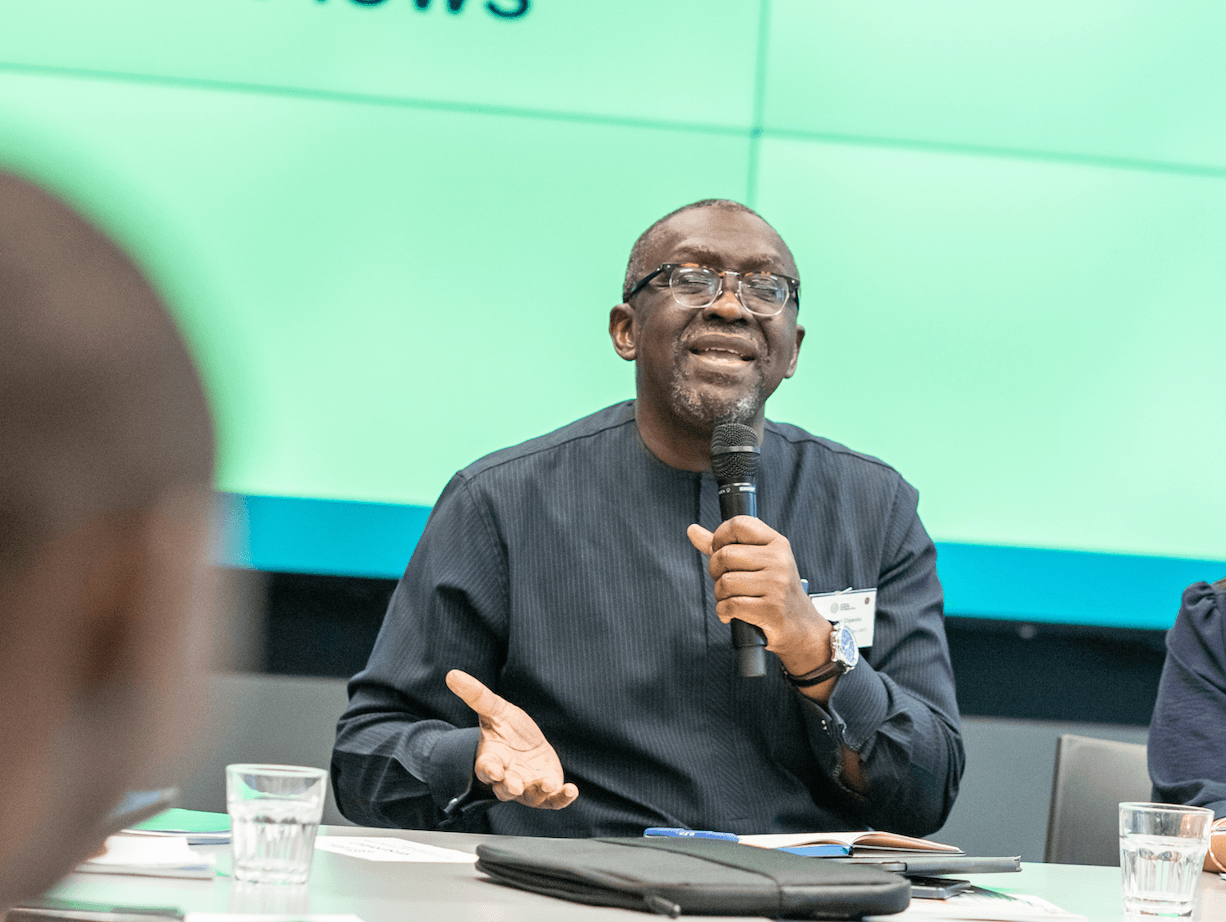

- Dr. Yemi Dipeolu, Sylvain Boko and Camilla Toulmin

Dr Adeyemi Dipeolu is a diplomat, economist, and public administrator and serves as Co-Chair of the Working Group on Illicit Financial Flows of the Africa-Europe Foundation. He is also Special Adviser to the Coalition for Dialogue on Africa (CoDA), a Faculty Member of the AfDB PFMA/MEMA Policy Lab Unit, Member of the Scientific Committee of the African Programme for Rethinking Development Economics, Adjunct Professor at the Nelson Mandela School of Public Governance of the University of Cape Town, Fellow of the Development Leadership Dialogue Institute of the School of Oriental and African Studies, University of London, and Member of the AfCFTA Trade and Industrial Policy Advisory Council.

Until May 2023, as Special Adviser to the President on Economic Matters in the Office of the Vice President of Nigeria, Dr Dipeolu led work on fiscal reforms, trade and industrial policy, development planning, innovation and digital economy. Dr. Dipeolu also served as Coordinator of the Africa Trade Policy Centre, Chief of Staff and Director of the Capacity Development Division at the UN Economic Commission for Africa. While at ECA he led work on Transformative Industrial Policy and on Conflict and Development in Africa. He headed the Secretariat of the High-Level Panel on Illicit Financial Flows from Africa, chaired by former South African President Thabo Mbeki.

Dr. Dipeolu started his career in the Nigerian Foreign Service, rising to the rank of Ambassador in Caracas, Addis Ababa, Pretoria and Geneva respectively. He is a Fellow of the Nigerian Economic Society and recipient of the Nigerian National Honour of Officer of the Order of the Niger (OON). He studied at the Universities of Ife, Oxford, Cambridge and South Africa.

As co-chair of the Africa-Europe Foundation’s Working Group on Illicit Financial Flows (IFF) can you tell me the main priorities of that Working Group and how they relate to the overall objectives of the Foundation?

The starting point is that the primary objective of the AEF is to improve Africa-Europe relations. So for us we want to build trust and leverage the Africa-Europe partnership to tackle IFFs. How do we support this objective? First, is to support actions in African countries to improve domestic resource mobilisation, including by stopping IFFs and identifying innovative sources of finance. But we also need efforts to strengthen the domestic financial architecture, including improved tax administration. So, we’d probably want to see more work by Tax Inspectors Without Borders and the Africa Tax Administration Forum.

The second priority is to identify actions which can be taken by Europe in this area, such as through technical assistance, such as the Team Europe Initiative on IFFs. But we also require from Europe changes in domestic measures to improve transparency and reduce profit-shifting, implementing country by country reporting, enabling public registries for beneficial ownership, as well as dismantling tax havens. The third thing would then be to encourage collaboration at the multilateral level including reform of the international financial architecture, negotiating the UN tax convention and supporting positive mutually beneficial outcomes at the Financing for Development (F4D) conference to be held in Spain next June. All of these multilateral forums have a number of elements supportive of tackling IFFs.

The Working Group includes members from a number of African and European countries, some representation from AU and the EU, and people from civil society organisations who contribute in various ways. I co-chair this group with Pascal St Amans who used to be at the OECD.

Have you been involved in this field for a long time? I think you played a major role in the Mbeki report on IFFs of 2015.

I was on the technical committee which served to backstop the high-level panel, and I went on to head the Secretariat which produced the final report.

What is the level of IFF from Africa, why does it matter, and what are some of the impacts on fiscal space?

It’s difficult to put a precise figure on IFFs since by their very nature, the whole purpose is to hide the flows. Various approaches have been made to assess the scale of the flows. The Mbeki Panel focused on looking at discrepancies in bilateral trade which came to $50bn a year, but these estimates have more recently been increased to $80bn. Once you take into account corruption, money-laundering and tax evasion, estimates of IFFs can reach $150bn or even $250bn a year. While the scale is important to give an appreciation of the size of the problem, what really matters is the loss of revenue to governments. It is significant that it was indeed the African finance ministers who asked for the Mbeki panel to be created. They said IFFs are affecting domestic resource mobilisation in a big way, this is money we can use for infrastructure, education, health and social protection. And I always like to remind governments that if there was greater domestic resource mobilisation within Africa, there would be less borrowing and if there’s less external borrowing, then you don’t have a looming debt crisis as we do now. So that’s part of it. Again, IFFs impact everything to do with governance, weakening state institutions, encouraging corruption and undermining the rule of law. So yes, the impacts are partly on finance and investment but also the weakening of governance and rule of law.

Taking a figure like $80-120bn a year or more, which is enormous, are there particular countries most exposed to IFFs or is it every country?

You find the problem in every country, mainly because all countries are engaged in trade. And all countries have multinational companies which put you at risk from base erosion and profit shifting. Obviously, the size of the economy plays a role, so the larger the economy the larger the potential flow of IFFs, and the greater the chance these activities are taking place.

What is the current state of the fight against IFFs from Africa, and what more needs to be done? How far have the many recommendations from the Mbeki report actually bitten?

You can judge the fight against IFFs in two ways. One takes the glass half empty, since the phenomenon certainly still exists. Take another problem like climate change, and you see this remains a big challenge despite a lot of international action to address it. It’s unrealistic to expect rapid improvements on a complex international issue like IFFs. The other way is to take the glass half full approach, which recognises there is far greater awareness now by all levels of government, private sector and civil society. Those previously dismissive of our efforts now accept there is a real challenge. When we started, the international financial institutions were sceptical, but to my great pleasure 4 or 5 years later things had changed. When I go to meetings of the International Monetary Fund and World Bank, I now see a number of events being held to discuss IFFs. We’ve seen a growing number of initiatives, such as negotiating a global tax convention at the UN. And also the tax framework developed at the OECD which indicates people recognise there is a problem. At the global forum for transparency and exchange of information for tax purposes, again there has been recognition of IFFs. We now have regional affiliates of the Financial Action Taskforce in Africa, working especially on issues relating to money-laundering and counter-terrorism finance. We’re not going to solve overnight a problem which has existed for more than a hundred years, but by tackling and creating awareness and advocating for governments to have political will I think we’ll make progress. I’m not saying that the Mbeki panel itself was enough. Nine years on, we cannot say all the problems have disappeared.

“We’re not going to solve overnight a problem which has existed for more than a hundred years”

Given this range of initiatives, where would you say is the primary place where these policies and measures need to happen - is it mainly at national level?

First if you take the international level, if the arrangements enable IFFs, then there is very little a country by itself can do. Which is why you find that even on issues of base erosion and profit shifting, big countries still find themselves largely powerless without international cooperation. That’s why you have the minimum tax agreement under the OECD Two Pillar Solution. The design of the international financial system is such that we need all hands on-deck to address IFFs. Second, we need national action to improve tax administration, and laws in place to regulate such behaviours. National action is also needed to create transfer pricing units. The uptake on this has been pretty good. If we take the glass half full, we can see many of the low-hanging fruit are already being picked as we continue to climb up the tree to get to harder-to-reach fruit.

The Mbeki report did make a number of recommendations for actions at national level, and I have mentioned some of the things that have already been done, such as establishing transfer pricing, anti-corruption, and financial intelligence units. Some of them are already present in certain countries, like the South African Revenue Service, which is highly regarded for the quality of the work it does. It wasn’t set up following the Mbeki report, but its example has enabled other African countries to know it is possible to have a good and effective revenue service.

Might it be time for a 2nd Mbeki report to focus attention again on IFFs and, if so, what should be its priorities?

I think there is certainly scope for a 2nd report. First, we should identify where things currently stand on IFFs from Africa, in terms of awareness, impact on economic, governance and social activities, and revising the estimates of IFFs, even given the inevitable shortcomings of these estimates. We can see in addition to the creation of the institutions I have mentioned, some countries have been working with UNCTAD - at least 12 countries have taken measures to examine trade mispricing and profit-shifting. Working Groups on IFFs have been established to improve interagency collaboration to prevent IFFs issues from falling through the cracks. We’ve seen progress with the African Tax Administration Forum and Tax Inspectors Without Borders scheme. We’ve seen efforts to improve capacities of African countries so they can negotiate better on tax treaties. And at international level, many people forget that the UN tax convention was a very important outcome from the Mbeki report.

But there are obstacles as well, because powerful players don’t like the whole idea of being subject to these dictates. Those with money and power feel that having something like this would go against their interests. Instead of having a fistfight, we have to identify the obstacles and see how we can accommodate particular interests while also making sure that basic issues are addressed. If you conduct economic activity in my country surely you should pay tax commensurate with the level of business you do there. You can’t go and hide your profits in a tax haven.

What are the issues raised in the report which haven’t received as much traction as the others? And how much does the debt burden of African countries change the situation, or equally the enormous growth in digital currencies?

Because of the importance of the extractive sector in Africa, we must ask how much is lost because of people negotiating secret contracts, allowing people to take out far more than they bring in. There are people who buy assets at ridiculously low prices and then, just a few months later, resell at 10-15 times the price. We have also been arguing that while legal processes are going on, these monies can be kept in escrow accounts at the African Development Bank – but how much of this has actually happened? As for the debt burden and digital currencies, they have both changed the picture quite a bit, so we should review our recommendations in the light of such changes over the past ten years, since the Mbeki report.

“Instead of having a fistfight, we have to identify the obstacles and see how we can accommodate particular interests while also making sure that basic issues are addressed.”

How do you see the relations between Africa and Europe as they concern the fight against IFF? What should European countries be doing better to help African governments in this fight?

The first need is greater collaboration to build trust on each side, and to raise up this subject to the highest political level so that it is addressed at the next Africa-Europe Heads of State summit, for instance. The EU has tremendous technical assistance to tackle IFFs from Africa but this programme should extend to commercial IFFs, tax evasion, trade mis-invoicing, aggressive tax avoidance, and not just focus on money laundering and terrorist financing. I hope to see greater engagement of the EU in the UN tax convention, building on the OECD’s work. Rather than seeking division between North and South, we should see this instead as a means for North and South to come together, recognising these are common concerns, which need common rules for how a global tax regime should be run. We also need to see more from African countries with regard to domestic policy to discourage illegal financial flows - and from Europe on trade mis-invoicing, access to public registries of beneficial ownership and supporting efforts to repatriate the proceeds of illicit flows. Something which concerned us a lot was the breakdown of trust over unexpected actions by the EU, such as blacklisting of certain African countries, which detracts from efforts to build cooperation.

There are a number of other arenas into which IFFs can flow, such as the UK and City of London, now no longer in the EU, and the UK’s associated tax havens. There are also other jurisdictions which have become very important, such as Dubai for finance and gold. You mentioned the mining sector in relation to negotiation of contracts, but there is also some evidence of illicit flows of gold out of certain African countries making their way to the Gulf. Did you cover these issues in the Mbeki report?

One of the things we avoided with the Mbeki report was finger-pointing. If you want uptake of the ideas, you don’t point fingers at either multinational companies or at individual countries. You explain the problem and then allow the issue to speak for itself. I’d be very reluctant to say country A or country B. We can all work together on the UN tax convention, bearing in mind that commercial IFFs account for over 60% of the total. So if you tackle the tax bit, you’ve done a fair bit. Pillar 2 of the OECD convention is a good start with the minimum tax of 15%, but it can also lead a race to the bottom. It would be better to go for 25-30% and encourage countries to move up from 15%. The panel did identify that when the US moved against “shell banks” just after 9/11, shell banks virtually disappeared from the global financial environment. If we can create similar political will and build on good practices like the automatic exchange of information for tax purposes, we can make progress. It is said that for reasons of confidentiality Africa does not benefit as much as it should from Exchange of Information arrangements.

We need to find the right balance between those who want a bit more confidentiality and those needing this information. There is more to be done with capacity building in tax administration, and adopting policies focused on transferring assets back to Africa. For example, the Lacey Act of the US enabled the return of revenues from illegally extracted resources – such as the revenues from illicit fishing from South Africa. The Act basically said: if you are guilty of illicit exploitation of resources, we are going to prosecute you and send the proceeds back to the country of origin, that’s what the law actually did. This is the kind of demonstration of good will between African and European countries that would help.

For mining, we spoke of the revenue losses associated with extractive industries, such as gold, oil, copper, timber. A lot of IFFs happen in these areas, and there is no doubt that the illegal extraction of commodities is central to the process. The Mbeki panel did not focus on specific resources. Instead, you have a number of successful sectoral initiatives such as the Kimberley process which covers how diamonds are extracted and the principles by which they enter the formal market. The Mbeki panel was looking at the losses derived from the general kind of contracting and processes involved in the extractive industries.

“There is more to be done with capacity building in tax administration, and adopting policies focused on transferring assets back to Africa.”

What is there on the EU side which is comparable to the US Lacey Act? The French government has seized assets acquired through illicit finance, such as residential property, held by family members of sitting heads of state or ex-heads of state. Is this one means for addressing IFFs?

These efforts can be important. For example, the Swiss, Luxembourg and US governments have identified and returned resources taken out by ex-General Abacha of Nigeria in the 1990s. While those efforts go on, the sums can be put in an escrow account at the African Development Bank which can then be lent back to African countries to help them on their development journey on more affordable terms. Efforts by individual countries are very welcome and could be generalised. The European Court of Justice has spoken about how public registries may not comply with EU law. It ruled that you have to demonstrate an interest to access the information on beneficial ownership, but certain countries have put hurdles in the way which make it difficult to show your interest in the matter. We need general agreement on how to frame it, so it doesn’t look as though you’re putting up barriers to getting relevant information.

Sylvain Boko Let me add something here. Aside from “bien mal acquis” efforts by the French, targeting the property of certain families, and what Yemi also mentioned regarding Switzerland, efforts to return cultural assets should also be part of this discussion. Many of these assets were illicitly acquired or looted during the colonial invasion. Now African countries are being told - yes, we have your artefacts, but we are not sure you can take care of your own assets – therefore, you have to show us you have built museums in order to get your assets back. One of the more recent examples concerns Benin which was in dispute with France about priceless artefacts, which have great cultural and spiritual value to the country of Benin. Many obstacles are often thrown in the way of the negotiations. Only a small number of assets have actually been returned and Benin had to show that they were able to provide the means to take care of these assets. One should not be given conditions to have access to our own assets which had been looted in the first place! These questions are likely to be explored more during the course of 2025, which the African Union has called the Year for Reparations and Reparatory Justice.